Will climate tech make good in 2023 on its bumper funding year of 2022?

Climate tech in 2022 saw an 89% increase in year-on-year venture capital, according to HolonIQ, with more than $70 billion invested from January to December. That’s all the more striking because 2022 was a fairly dismal year for venture capital funding in general — dollars invested were down 42% in the first 11 months of the year compared to 2021.

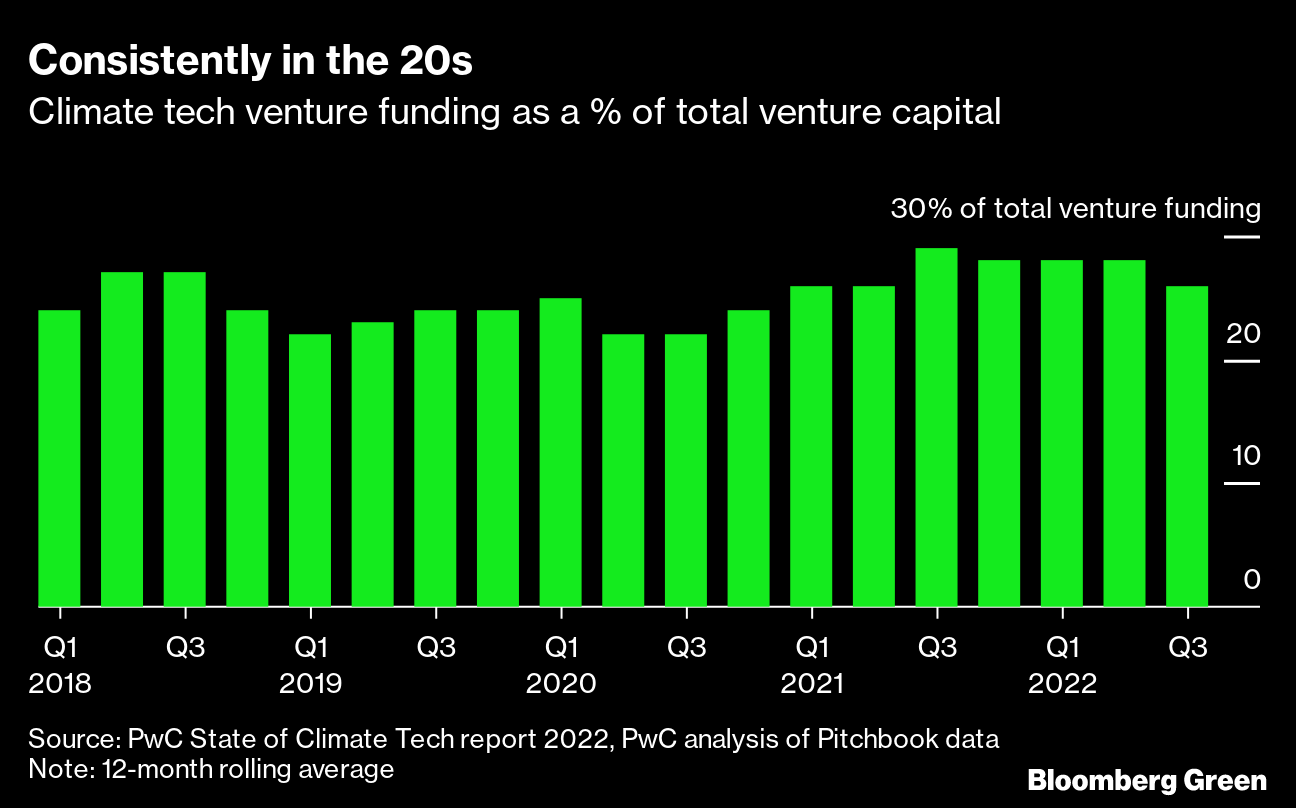

For the past four years climate tech has represented between 20% and 30% of total venture investment. That held steady when the venture market more than tripled and also when it pulled back sharply. As we receive more data on total venture funding in 2022, climate tech could prove to have been an even bigger percentage of the global pie.

Last year’s flow of money into climate tech was substantial — more than 35 times as much as a decade earlier. Now deployed into early-stage companies, it will spur a wave of new products and business models.

The OPC verdict on this

Sector continues to grow rapidly and remains robust relative to other sectors due to regulation and the exponential nature of the climate crisis.

It provides a very healthy ecosystem for investors moving forward in terms of exit opportunities and M&A.

2023 is the year that Climate Tech overtakes Fintech.

Sector review: Marine electric propulsion - Is 2023 the year the marine EV sector finds its sea legs?

Arguably electric propulsion in the maritime world got off to a sluggish start relative to the automobile industry with the main manufacturers from Honda to Volvo focusing on four wheels initially. Who would've thought that the automotive industry would be where it is today with 1 in 7 new cars registered in Dec 2022 being electric? This societal shift is being driven both by consumer demand, but also government regulation (the government is currently on course to ban the sale of new cars and vans powered entirely by petrol and diesel by 2030 and ban the sale of new hybrid vehicles by 2035)*.

Relative to the car industry, the marine electric propulsion market in the United Kingdom is still in its early stages, but it is expected to grow significantly in the coming years. The global electric boat industry generated $5.0 billion in 2021, and is anticipated to generate $16.6 billion by 2031, witnessing a CAGR of 12.9% from 2022 to 2031.**

This demand is being driven, like most climate change trends, by both consumer demand and government regulations. We are starting to see targeted regulations for the sector - for example Amsterdam’s new Green Party mayor has banned diesel engines from the centre’s ancient canals by 2025, helping the city’s efforts to combat climate change. Of Amsterdam’s 12,000 recreational boats, mostly smaller privately-owned vessels, only 5% are emissions-free, by city estimates***. This represents both disruption and opportunity.

In the United Kingdom, there are several regulations related to marine electric propulsion:

The Climate Change Act of 2008: This act established legally binding targets for reducing greenhouse gas emissions in the UK. As part of this act, the UK government has set a target of reducing emissions from shipping by at least 50% by 2050, compared to 2005 levels. This target is expected to drive the adoption of electric propulsion and other clean technologies in the shipping industry.

The Clean Air Strategy of 2019: This strategy sets out a number of measures to improve air quality in the UK, including the reduction of emissions from shipping. The strategy includes a number of proposals for promoting the adoption of electric propulsion systems, including research and development funding and the development of charging infrastructure.

European Union (EU): The EU has implemented a number of regulations to reduce emissions from shipping, including the European Union Emission Trading System (EU ETS) and the EU Monitoring, Reporting, and Verification (MRV) regulation. The EU ETS puts a cap on the amount of CO2 that ships can emit, while the MRV regulation requires ships to monitor and report their emissions.

Partly due to these regulatory ‘push’ factors, OnePlanetCapital decided to make a play into the UK marine electrical propulsion market with an investment into RAD Propulsion in March 2022. RAD Propulsion is a Southampton based engineering and tech business formed to develop the next generation of propulsion systems for all types of marine applications, from outboards to larger zero emission vessels. The RAD team comprises a team of naval architects, systems engineers and automotive experts who are all passionate about the water and have an in-depth understanding of the marine environment.

For those interested in the sector and gaining exposure to UK-based early stage companies in electrical propulsion, OnePlanetCapital are considering a follow-on investment into RAD Propulsion in March 2023. For any investors interested please contact the team.

Sources:

*https://heycar.co.uk/blog/electric-cars-statistics-and-projections

***https://www.reuters.com/article/us-climate-change-netherlands-idUSKBN20Q1W7